tennessee inheritance tax laws

For example the neighboring state of Kentucky does have an inheritance tax. Its paid by the estate.

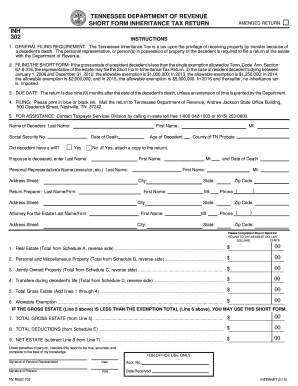

Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow

The inheritance tax is different from the estate tax.

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)

. 2013 - Online Inheritance Tax Consent to Transfer Application. This is a type of inheritance law where each spouse automatically owns half of what they each obtained while married. The inheritance tax applies to money and assets after distribution to a persons heirs.

If a decedent had children but no spouse the children take everything. Ad pdfFiller allows users to edit sign fill and share all type of documents online. These are the different tax laws by state.

There are 38 states in the country that do not have an estate tax in place. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. Since the Tennessee legislative code refers to both an inheritance tax and an estate tax this article refers to the death tax that is currently collected under Tennessee law as an inheritance tax even though the tax is assessed against the assets located in Tennessee and.

The good news is that Tennessee is not one of those six states. All inheritance are exempt in the State of Tennessee. An inheritance tax is a tax on the property you receive from the decedent.

However it applies only to the estate physically located and transferred within the state between Tennessee residents. Tennessee does not have an inheritance tax either. The taxes that other states call inheritance taxes are not based on the total value of the estate.

2 An estate tax is a tax on the value of the decedents property. In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time. Tennessee Inheritance Tax Laws When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice.

For nonresidents of Tennessee an estate may be subject to the Tennessee inheritance tax if it includes real estate andor tangible personal property having a situs within the state of Tennessee and the gross estate exceeds 1250000. We hope the following information provides some basic information about Tennessees inheritance and gift taxes. Info about Tennessee probate courts Tennessee estate taxes Tennessee death tax.

1 PDF editor e-sign platform data collection form builder solution in a single app. 2012 - Inheritance Tax Changes. In May 2012 legislation.

In 2012 the Tennessee General Assembly. Technically Tennessee residents dont have to pay the inheritance tax. Up to 25 cash back Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million.

This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax. Questions Answered Every 9 Seconds. There is a chance though that another.

There are NO Tennessee Inheritance Tax. Inheritance Tax in Tennessee. 2006 - Qualified Tuition ProgramsInternal Revenue Code IRC Section 529 Plans.

Tennessee Inheritance and Gift Tax. Ad A Tax Agent Will Answer in Minutes. The Federal estate tax only affects02 of Estates.

If a decedent had a spouse and descendants all. If a decedent had a spouse but no children or grandchildren the spouse takes everything. They are imposed on the.

Until that time estate administrators must continue to file the appropriate returns and pay the required estate taxes. Under states that abide by community property law after one spouse passes away half of their estate immediately goes to their partner and the other. In January of 2016 Tennessee repealed its inheritance tax to encourage.

In 2016 the inheritance tax will be completely repealed. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Tennessee has updated its tax laws recently regarding both its inheritance tax and gift tax.

In Tennessee the intestate succession laws are. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. As well as how to collect life insurance pay on death accounts and survivors benefits and fast Tennessee probate for small estates.

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received.

Where Not To Die In 2022 The Greediest Death Tax States

Is There A Tennessee State Estate Tax Mendelson Law Firm

Inheritance Tax And Gift Tax In Tennessee Nashville Estate Planning Lawyers

Tenncare Tax Waiver Fill Out Sign Online Dochub

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Tennessee Tax Resolution Options For Back Taxes Owed

Complete Guide To Probate In Tennessee

Does Kansas Charge An Inheritance Tax

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

State By State Estate And Inheritance Tax Rates Everplans

Tennessee Inheritance Tax Repealed Estate Planning Review Nashville

Tennessee Real Estate Transfer Tax And Exemptions Tenn Code Ann 67 4 409 Nashville Commercial Real Estate Attorney

Tennessee Short Form Inheritance Tax Form 2000 Fill Out Sign Online Dochub

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

New Tennessee Laws To Take Effect July 1 2022 Tennessee Senate Republican Caucus

Major Changes To Estate And Inheritance Tax Laws Kizer Gammeltoft Brown P C